How to Pay Taxes for Your E-Commerce Business

Running an online business means your storefront is global, whether you’re selling custom prints, vintage clothing, or your unique art on platforms like Etsy. But where there’s income, there are taxes, and knowing how to handle them is essential.

In this guide, we’ll walk you through the key tax considerations for e-commerce businesses in Canada.

Do E-commerce Businesses Pay Taxes in Canada?

Yes, e-commerce businesses in Canada follow the same tax rules as traditional businesses. Your tax responsibilities depend on how your business is legally structured—whether as a sole proprietorship, partnership, or incorporation. The structure you choose impacts how you’re taxed, what liabilities you have, and what forms you’ll file at tax time.

Do I Need to Register My E-commerce Business in Canada?

Yes, you need to register your business, but how you register depends on your business structure:

- Sole proprietorship: You run the business on your own, and it’s unincorporated.

- Partnership: Two or more people operate the business.

- Incorporation: Your business is a separate legal entity.

If you’re still deciding which structure makes the most sense for your online venture, services like TurboTax can help guide you through the process.

What If I Sell Both in Canada and Internationally?

The Canada Revenue Agency (CRA) expects you to pay income tax on all online earnings, no matter where your customers are located. The key difference between domestic and international sales is that international customers don’t pay Canadian sales tax.

Do I Have to Charge Sales Tax?

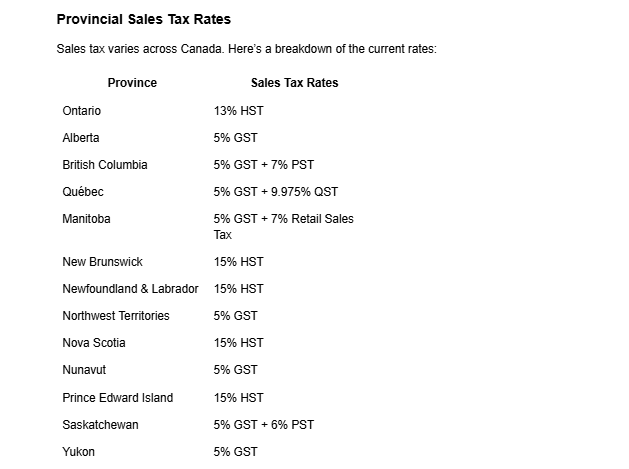

If your business generates over $30,000 in revenue annually (or in a single quarter), you must register for a GST/HST account. Once registered, you’ll need to charge sales tax based on the province you’re shipping to.

For example:

Stephen, who lives in Ontario, sells art supplies online. He makes a sale of $100 to a customer in Québec. Stephen needs to charge 5% GST ($5.00) and 9.975% QST ($9.98), making the total $114.98. He’ll report $100 in sales and $14.98 in sales tax on his next sales tax return.

If you’re unsure whether you’ll exceed the $30,000 threshold or want to set up a GST/HST number in advance for better record-keeping, it’s worth looking into how to register and report GST/HST.

How Do I Report My E-commerce Business on My Tax Return?

If your e-commerce business is your primary job, you’ll be taxed on your net income—your total income minus business expenses—just like any self-employed person.

Be sure to report the percentage of income earned from each platform you sell on. For instance, if you’re using Etsy, they will provide an income statement to use when reporting on your tax return.

Keep in mind that sales tax may be collected and remitted on your behalf by certain platforms, but you’re still responsible for filing your sales tax return and paying any remaining balance.

If your business income pushes you into a higher tax bracket, any earnings over the threshold will be taxed at a higher rate.

What Expenses Can I Claim for My E-commerce Business?

Tax deductions are a significant advantage for business owners. As an e-commerce entrepreneur, you can claim many of the same deductions as brick-and-mortar stores. Here are some examples:

- Website hosting fees

- Shipping and packaging costs

- Marketing and advertising expenses

- Office supplies and equipment

To ensure you maximize your deductions and reduce your tax liability, check out our Big List of Small Business Tax Deductions.

Capital Cost Allowance (CCA)

For larger business assets, such as office furniture or computer equipment, you can’t claim the full cost all at once. Instead, you’ll need to deduct it over several years using Capital Cost Allowance (CCA). For example, office furniture is typically deducted at 20% annually, while machinery and equipment are deducted at 30%.

Managing an e-commerce business can be rewarding, but understanding your tax obligations is critical. With careful planning and good record-keeping, you can stay compliant with the CRA and focus on growing your business.

Key Takeaways

- The same tax laws apply to both traditional and web-based businesses.

- If your e-commerce revenue exceeds $30,000, you must register for a GST/HST number.

- Sales tax rates vary by province and territory.